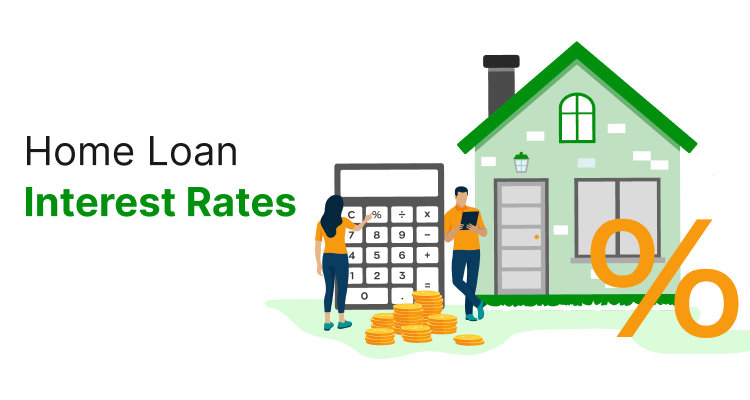

Home Loan Interest Rates 2025 – What You Need to Know

Buying a home in 2025 feels exciting but also confusing with so many interest rate changes. Banks and NBFCs are offering competitive schemes, but small differences in rates can save you lakhs over the years. If you’re planning to apply for a home loan, compare offers carefully, check prepayment options, and understand the hidden charges before signing.

Why More People Are Shifting to SIPs Instead of FDs

Traditional fixed deposits are losing charm as inflation eats into returns. Many young professionals are moving towards SIPs (Systematic Investment Plans) in mutual funds because they not only beat FD returns in the long term but also create wealth with discipline. The best part? You can start with just ₹500 a month.

Credit Score – The Silent Factor Behind Loan Approvals

Most people only think about their credit score when their loan gets rejected. But in 2025, lenders are using AI-powered models that check repayment behavior in detail. A good score not only helps you get approved but also ensures lower interest rates. Paying credit card bills on time and avoiding too many loans at once can dramatically improve your score.

Insurance is No Longer Optional – Here’s Why

Medical emergencies and job uncertainties are making insurance a necessity, not a luxury. Life cover, health insurance, and even home insurance are becoming must-haves for financial security. People have realized that one medical bill can wipe out years of savings – which is why 2025 is seeing a rise in affordable term and health insurance plans.

Tax Saving Hacks for Salaried Professionals

Every year, many salaried employees end up paying more tax just because they don’t plan. From investing in ELSS funds, buying health insurance, to using NPS – there are multiple ways to reduce your tax liability legally. The key is to start planning early in the financial year instead of rushing in March.